Before we dive into the world of cfd trading, let’s initial determine what CFD means. CFD or Contract for Big difference is undoubtedly an contract between two events where big difference in worth of the tool initially and end of the industry is paid out in money. CFD buying and selling will allow forex traders to speculate on selling price motions in a variety of tools for example stocks, indices, commodities, and currencies. This type of forex trading provides leverage, that enables traders to industry having a smaller capital in comparison with traditional market segments. However, it also brings threats that dealers need to comprehend and deal with. In this comprehensive information, we’ll include the basic principles of CFD forex trading and tips on how to be a profitable CFD investor.

1. Know the root tool – Before forex trading CFDs on any device, it’s significant to experience a very good understanding of the actual advantage. Make time to analysis and evaluate the financial and political aspects that will impact the instrument’s selling price motions. Continue to be current together with the latest reports and tendencies and employ technological evaluation equipment to distinguish potential entrance and get out of details.

2. Control your risk – CFD forex trading gives leveraging, which can boost your earnings but will also bring about substantial deficits or even maintained effectively. One way to handle threat is to apply stop-decrease orders placed to automatically near your position as soon as the value reaches a definite level. One other way would be to branch out your portfolio by investing diverse equipment rather than adding all your investment capital into 1 industry.

3. Mind your border and service fees – CFD investing requires margin, which is actually a percentage of the trade’s benefit that you need to deposit as security. Understanding margin requirements and the way they impact your revenue and failures is vital. Also, be aware of the fees incurred from your broker such as spread and right away costs. Be sure to examine various agents and their costs before selecting a single.

4. Build a buying and selling plan – A trading program is a collection of rules and recommendations that determine your method of buying and selling. It will include your investing goals, threat administration approach, entrance and exit conditions, and also the tools you’ll industry. Having a investing prepare can help you stay away from psychological investing judgements while keeping you focused entirely on your goals.

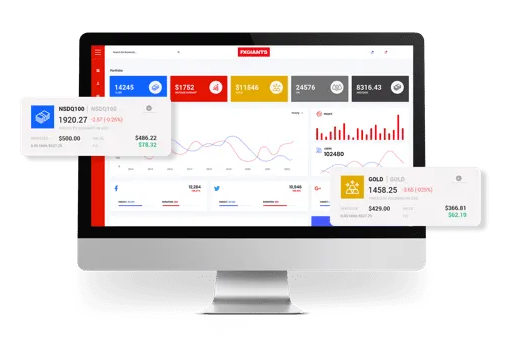

5. Training, training, process – Like any ability, CFD investing requires practice to learn. A lot of brokerages supply demonstration profiles that replicate real investing problems though with online dollars. Use trial profiles to test out your forex trading strategies and familiarize yourself with the forex trading platform before trading with real cash.

Conclusion:

CFD investing might be a lucrative and thrilling way to get involved in the stock markets. But it’s important to understand that buying and selling carries threats and needs a disciplined strategy. By knowing the primary tool, managing your risk, minding your border and service fees, developing a forex trading plan, and rehearsing on demo balances, it is possible to boost the chances of you being a profitable CFD dealer. Always keep updated together with the most recent reports and styles and do not spend a lot more than within your budget to shed. Delighted trading!